Sales consultants at Health Insurance Companies (H.I.C) provide substantive information on various health insurance plans to potential clients. They help people make perfect choices by educating them on the benefits of health insurance and the fee charged for various plans. Further, they negotiate contracts on behalf of the customers (Pilzer 22).

A sales consultant may decide to work for a specific insurance company or for many companies. They must obtain a license before providing their services. Though they may work from offices, they travel often to meet various clients. The minimum requirement for these professionals is a high school diploma.

Health insurance helps individuals cover all unexpected medical costs. It is also useful when people are searching for preventative care. The best thing is that most health insurance covers also include the family members. Therefore, it is possible for a whole family to enjoy perfect health just by paying small amounts of money per month, also known as premiums (Green 13).

Health insurance plans are mainly offered by private insurance companies. They offer comprehensive health benefits inclusive of hospital care, medicine, laboratory services, rehabilitative services and preventative care among other things. Choosing a specific insurance plan depends on an individual’s needs and financial ability. People who may not have low income can qualify for free coverage via Medicaid.

This paper seeks to investigate the required conditions and peculiar demands for sales consultants at health insurance companies. It assesses the potential present in society for the absorption of new recruits in the field and the possible benefits that could arise for successful graduates from both the tangible and the intangible resources.

The Demand for Sales Consultants at Health Insurance Companies

Sales consultants at health insurance companies are on very high demand today. The medical costs in many health facilities are very high and majority of people can hardly meet such costs, especially in the light of tough economic times. Therefore, to ensure that individuals can be treated at the right time and at the hospitals of their choice, more and more people have opted for health insurance covers.

However, due to budget constraints and lack of information, many people are unable to select a good insurance cover. Even with the exposure to the internet, people do not have enough time to study different types of insurance covers. The health insurance companies would require some individuals to educate these potential clients on their behalf. It necessitates hiring sales consultants on both short and long-term basis (Pilzer 12).

Williams (2015) indicates that many companies are searching for consultancy services today as opposed to hiring employees. This is primarily because it is less costly to hire such individuals. Employing a sales person on a long-term basis means that they are entitled to a salary, even when they are unable to do any substantial brokerage during the month. On the other hand, consultants are only paid on a commission basis. This means a company will only pay them once they have sold an insurance plan (Williams 7).

Still, many insurance companies may require the additional skills and experience of a consultancy firm. Therefore, a company has the chance to choose the best sales persons, and get excellent deals in a short while. Importantly, consultants can offer a very good advice that can help insurance companies achieve their goals and objectives. They offer advice from an outsider’s perspective, which means that they may notice some issues in a company more quickly than an employee who has been working there for a long time.

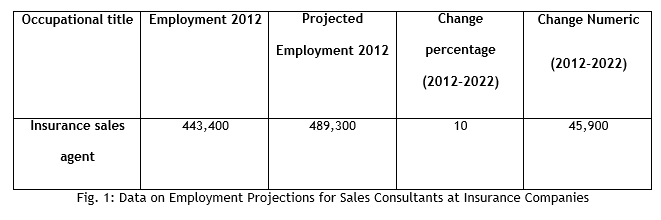

The prospects for job growth in the field of insurance sales consultancy are very strong. Bureau of Labor Statistics indicates that the demand for these professionals will increase by 10% from 2012 -2020 (“Occupational Employment and Wages”). The growth rate is as fast as that of most of the professions.

As the American population ages in the next few years, the demand for health insurance covers is likely to be on the rise. Further, the reform legislation by the federal government may make it possible for people to access insurance covers. It will actually create a new client base, and the insurance companies will rely on sales agents to reach out to the new client base. Still, people are more aware of the benefits of maintaining good health today than in the past. Therefore, they may want to have some form of insurance to access preventative health care services (Pilzer 32).

Map Your Success Out!

Attract high grades like a magnet! Time to get on the right side of your professor.

Compensation for Sales Consultants at Health Insurance Companies

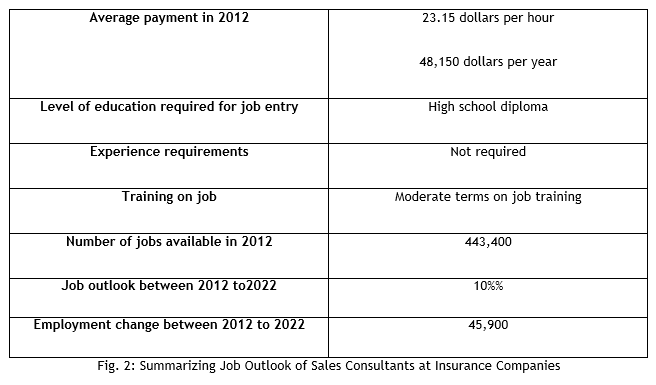

According to the data from the Bureau of Labor Statistics, the median annual salary of a sales consultant in an insurance company was 48,150 dollars in 2012. The highest paid consultant earned $116,940, while the lowest paid one earned $26,120 (“Occupational Employment and Wages”).

Sales consultants at health insurance companies are paid on commission basis. Some of them may be paid a basic salary on top of the commission or even award bonuses. Thus, a consultant’s salary will differ depending on the policy of a particular company. Hence, the type and cost of an insurance policy will determine a consultant’s commission. Choosing the insurance company that pays the best commission and opting for the type of insurance policy that has better commission will help a sales person get a more favorable compensation in the long run (Pilzer 5).

Pay scale indicates that at the entry level, a sales consultant on insurance may earn 10% below the average. However, they earn 5% more at mid-career, 13% more as they gain experience, and 29% more at late career.

Certain skills of a sales consultant agent affect the amount of salary. Graduates with excellent communication and customer care skills will have a better compensation because they make many sales at short notice. More so, multilingual sales persons with some legal background can serve a wide range of clients, selling more insurance policies. The best professionals in the field should be able to offer a wide range of products to suit different clients. This may mean working for different insurance companies (Nichols par.13).

Compensation for sales consultants also depends on the number of working hours. Normally, sales consultants determine their number of working hours. They may work during the day, as well as on weekends and evenings schedules to serve various clients, or they may decide to meet the clients during working hours. Some consultants work on part time basis while others work on full time basis. In 2012, Bureau of Labor Statistics indicated that at least one out of five consultants worked for approximately 40 hours every week (“Occupational Employment and Wages”).

Finding a Job as a Sales Consultant at Health Insurance Companies

The government requires every sales consultant at insurance companies to be licensed before offering their services. This license is only offered to the individuals who complete some courses and pass state exams on the basis of insurance and the law relevant to the field. To keep the license, more exams have to be conducted on a regular basis, covering insurance law, ethical issues, and consumer protection (Swanson & Nadya 34).

Finding about job opportunities as a sales consultant in health insurance companies can be done through proper networking. An individual could contact people working within various companies, and find out about the details of the opportunities available. Going through the advertisements and contacting job agencies can come in handy in this case.

Internet is also a very good platform to find job postings and apply for them. Many employers have turned to the platform today to seek for employees. Still, yellow pages both in the online and offline platforms can be of good help. Pope and Jesse (2009) point out that if a job is not available within a given company or institution of choice, one may want to consider the possibilities of volunteering. An individual will gain substantial experience due to training in a field. Moreover, they will receive firsthand information regarding the availability of new opportunities. One can also apply for a long-term internship program (Pope & Jesse 25).

Contacting a specific person in an institution is very important when finding a job. These people may offer some information on the qualifications required for some positions, and the compensation programs within the company. They can even help one prepare well for an interview. It is not difficult to get such contacts through networking.

Step 1. Order Placement

Step 2. Order Payment

Step 3. Paper Downloading

Career Growth and Development for Sales Consultants at Health Insurance Companies

Career growth and development is important for every employee. Career growth simply means the ability of an individual to climb an organization’s ladder and a career lattice. Going up this ladder means a vertical movement between jobs, while the career lattice combines the aspects of vertical and lateral movements in an organization (Swanson & Nadya 24).

Career development includes all the activities that employees do, so that they can advance in their career. The employee may engage in these activities without necessarily moving either vertically or laterally in an organization. However, once they have attained a certain level, many employers will consider them for promotions or increase of responsibility within an organization. Furthermore, an employee can decide to search for better jobs in other companies (Ron par.5).

Asma indicates that career growth and development benefit both the employers and employees. The employer will get more productive work force while an employee will have the chance to get a better compensation and, at the same time, have better job satisfaction. Any employee will expect their employers to support them in their bid to advance their career even as an organization grows. The employees who never seem to make any effort in this regard may be termed redundant, which can lead to their lay-off.

For such a career growth and development to take place, training is mandatory. An individual may consider returning to school for further studies or even taking courses offered by their company. More so, attending seminars and conferences may offer an individual the chance to get the relevant training. Many companies even organize these seminars so as to offer all the employees a chance to become better at their career. Newly hired employees, who may have been introduced into an organization’s culture, consider such training important. With time, they are allowed to come up with a well-mapped career path.

Experience is also taken into consideration when it comes to career growth. People who may have overstayed in an organization may be promoted after a short while. However, for this to happen, an individual must be in a position to prove that they have acquired enough skills in their job. In particular, they must have specialized in certain areas in an organization (Swanson & Nadya 32)

We help students to get better grades regardless of the

complexity of the task. Make our talent and expertise work for you!

Becoming a sales consultant at a health insurance company should only be a start for any employee. There are other options to consider in such a career. An individual can decide to obtain a license to enable them to sell other products or services such as securities or any other financial products. Additional exams may be required in this case, which is administered by Financial Industry Regulatory Authority. This exam can either be series 6 or 7. Series 6 exam is meant for people who want to sell mutual funds and variable annuities, while the series 7 is meant for general securities sales representatives.

With time, a sales consultant should be able to acquire a number of skills, including sales management, online sales, communication skills and insurance law. It is also important to take courses, such as psychology and sociology, in order for them to be able to interact with various clients. Importantly, if an individual started as a higher diploma graduate, they should consider enrolling for undergraduate and post-graduate degrees.

Sales consultants should consider establishing their own firms and expanding them. This way, they may be able to employ other young and inexperienced sales consultants and offer them training. They may also offer courses online and share their experiences and skills they may have acquired over time.

The option of being employed in insurance companies as managers and in other leadership positions is also open. Some will be promoted to levels such as personal line managers and underwriters after working for a company for more than three years.

Coming Up With a Career Plan

After considering all the options available in sale consultants’ career growth and development, an individual must come up with a plan. Thus, potential employees must design short and long-term goals and write them down. It will become a form of a checklist needed throughout their career. It will actually help them to evaluate their achievements and even failures in order to make the necessary adjustments. The objectives of a career growth and development should be SMART (specific, measurable, action oriented, realistic, and time bound) (Swanson & Nadya 30).

In the first year of working as a sales consultant, an individual may decide to take time to acquire enough experience in the field. If a job is not available immediately after their graduation, they may opt to volunteer or work as an intern. During the second year, they may opt to take various courses in their areas of interest. Most organizations may have offered various courses by then. After two or three years, an individual can advance in their education by taking and getting into private practice afterwards.

To come up with a career growth and development plan, it is important to consider several aspects. These include the abilities, goals, values and perceptions. The aspect of abilities means how employees view themselves, and what is their capacity to deliver services that matter to other people. The aspect of goal and values means considering what matters most to an individual. On the other hand, the aspect of perceptions borders on how other people view them. These facets are imperative when it comes to GAP analysis.

It is important to think about the issues that are in line with an employer’s developmental goals and objectives before thinking about career growth (Asma par.6). One must be seen to meet certain needs in an organization, which will make an employer consider them for promotion or more responsibilities. For instance, if an individual identifies a gap in leadership, they should acquire skills and seek for opportunities to lead teams.

An employee should consider the market trends while developing a career plan. For instance, many potential clients may want to find information about insurance through the online sources. A sales representative should be able to build a website and provide such information to these clients (Pope & Jesse 280).

Conclusion

Sales consultants at health insurance companies are mandated with the work of providing relevant information on insurance policies from different companies to potential clients. They may work for a single insurance company or for various companies.

A career in sales consultancy at health insurance companies is lucrative. The demand for these professionals is always high. The Bureau of Labor Statistics specifies that a demand for them will increase by 10% in the next few years (“Occupational Employment and Wages”).

The compensation for the sales consultants is good. Annually, the professionals earn an average salary of 41,150 dollars. There is a chance for better compensation as one gains experience and training in the field.

There are higher chances of growing and developing in a career through training programs. The professionals have the chance to specialize in different fields, and even to establish their own firms. Coming up with a good plan can prove useful when it comes to career advancement.

To find a job as a sales consultant in health insurance companies, an individual should make applications both on the online and offline platforms. Further, one can start as an intern or a volunteer in order to take advantage of job opportunities arising within specific organizations. Networking will also help them to find such an opportunity with ease.

Don't spend another minute

worrying about deadlines or grades. Have a question? Chat with us!